How To Discover And Research NFTs Before They Blow Up

Are you always missing hot NFT mints and having to buy on the secondary market at premium prices? A big reason for this is due to lack of research. In this guide, we cover the essential NFT research tips to help you stay ahead of the game. Here are 7 tips to help you decide what are great NFT projects to get into early.

Table of Contents

1) Monitor Upcoming NFTs

The first step to not missing out on NFT drops is to keep a close watch on up and coming NFT launches. You can check out all upcoming NFT drops on the Wagmi.tips NFT Drops page when looking for new projects to get into.

2) Join Alpha Groups

Alpha groups are essentially groups of well-connected, serious NFT investors who have ‘insider’ information on what projects are going to blow up next. While many purported NFT alpha groups have fizzled away during the bear market, some prominent ones still exist such as PROOF Collective. Before joining an alpha group, it is important to know what kind of methodology they employ when determining hot NFTs such as using analytical tools or through connections with teams of popular upcoming NFTs.

3) Use NFT Analysis Tools

Simply put, NFT Analysis tools help buyers understand a project before committing. You can see useful data such as sales volume, holder data (such as percentage of blue chip holders), floor price history etc. Here are some popular tools for NFT analytics:

4) Avoid Obvious Red Flags

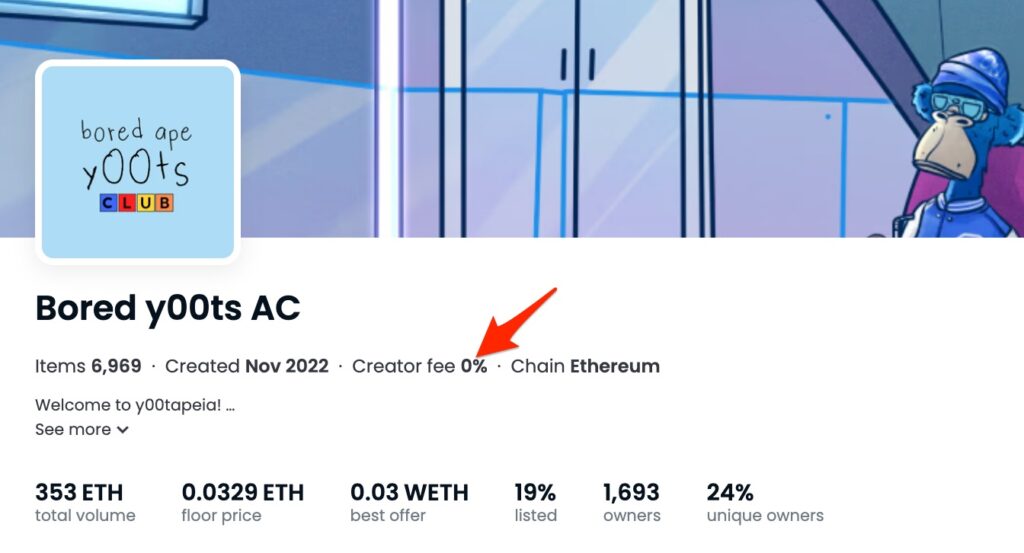

We talked about ways to find potentially profitable NFTs but haven’t touched on the importance of avoiding red flags in NFT projects. With so many scams popping up these days, one cannot be too careful. Here are some obvious red flags to look out for:

- Many Twitter followers but no engagement

- Super high OpenSea royalty fee (>7%)

- Unoriginal or low-effort artwork

- Undoxxed team (not all are red flags but you need to be more cautious here)

- Lack of or useless utility

- Artificial sales volume via wash trading

- Or pretty much a project that offers no differentiation from others (aka ‘copy pasta’ NFT project)

5) Join Their Community

Before an NFT is launched, the project will typically create a lot of community-based initiatives such as whitelist opportunities, early bird Discord, a minting website and also content detailing what the project is about. It is always a good idea to get involved in their social activities or do some research on these assets to determine the legitimacy of this project. You’ll also want to look out for shady activities such as fake engagement or a lack of responsiveness from the team.

6) Assess A Project Based On Their Promises (Think Like An Investor)

Before aping into an NFT project, think of yourself as an investor. Any NFT project will have to “pitch” you on why their project makes sense. Almost every project will definitely have its team, utility, and roadmap.

NFT Utility is what you get when you buy the NFT. NFT Roadmap is what you will get in the future when you buy the NFT. A solid NFT project should be run by a strong, experienced team for successful execution of the deliverables. Team members should ideally include a founder, an artist, a marketer / community builder and a developer. They may not need to be full time, as long as they have the competency to deliver on the promises.

Do they have prominent backers? Sometimes, when there are reputable companies or celebrities behind a project, it is less likely to be a failure as these prominent figures have staked their reputation behind these projects.

7) Study The Market And Monitor Trends

Sometimes, no matter how hyped up a project seems, it can be affected by the macroeconomic situation. In times of uncertainty, investors are less likely to take on financial risk, which can lead to otherwise solid projects failing. However, if you are confident in the project and team and would like to invest for the long term, it could work in your favor.

Summary

Researching NFTs is tough. Many times you will make bad choices but somethings all it takes is a few good calls to change the game for you. As the saying goes, “DYOR” (Do-your-own-research) is the best strategy when evaluating any given project.

FINANCIAL DISCLAIMER

None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, NFTs, products or financial instrument, to make any investment, or to participate in any particular trading strategy.

Any expression of opinion (which may be subject to change without notice) is personal to the author and the author makes no guarantee of any sort regarding accuracy or completeness of any information or analysis supplied.

The authors of Wagmi.tips are not responsible for any loss arising from any investment based on any perceived recommendation, forecast or any other information contained here. The contents of these publications should not be construed as an express or implied promise, guarantee or implication by Wagmi.tips that users of the website will profit or that losses in connection therewith can or will be limited, from reliance on any information set out here.