The Complete Guide To NFT Royalties – What You Should Know

According to Galaxy Digital, NFT creators on the Ethereum blockchain have received close to $2 billion in royalties, with none other than Yuga Labs leading the pack. In recent years, NFT royalties have introduced an important income stream to NFT creators, especially for aspiring artists. This article explains what they are and why they are important to the sustainability of this industry. Let’s go!

Table of Contents

What Are NFT Royalties?

NFT royalties are payouts (usually in crypto) to the respective creators that give them a predetermined cut from each sale on the secondary market. These royalties are set by the creators based on several factors including mint price, number of editions, type of NFTs, etc.

What's The Usual NFT Royalty Range?

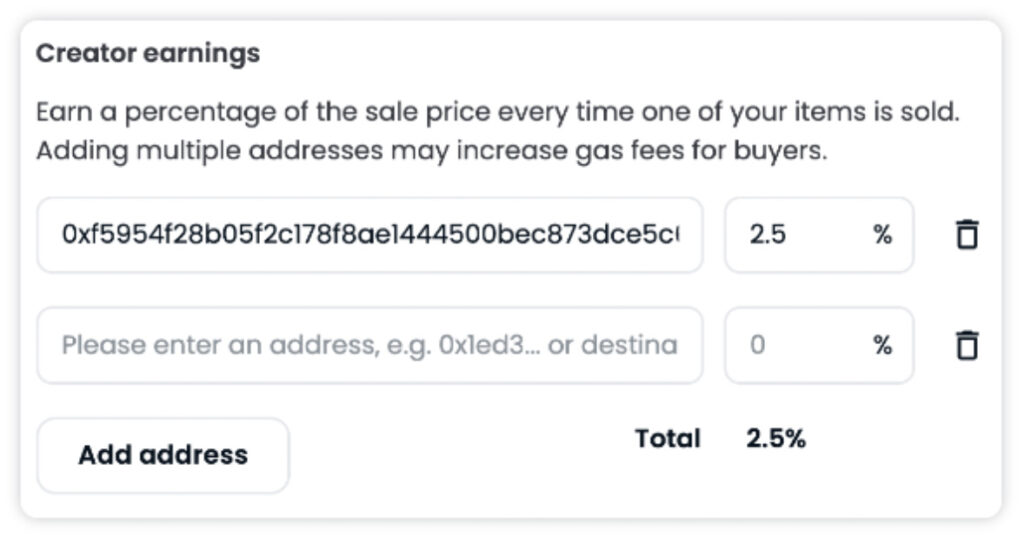

The typically range of NFT royalties is from 2.5% to 5%, with OpenSea allowing creators to set up to 10%.

To learn how to set NFT royalties on OpenSea, follow this guide.

What Are The Benefits Of NFT Royalties?

Compared to the conventional system, this system returns to artists what is rightfully theirs. Before the arrival of blockchain technology, smart contracts, and NFTs, artists only received a one-time revenue from the primary sale of each artwork. If said artwork appreciates in price in the future, the artist usually gets no monetary rewards. Even if the artist sets a resale royalty, it is extremely difficult to track the resale transactions in the secondary market. Unfortunately, the art industry and the music industry have already been held captive by unfair compensation for decades.

With smart contracts in place, NFT royalties are released to the artists automatically. To date, artists, musicians, and other content creators have benefited from the arrival of this technology. When Beeple’s 1/1 Crossroads NFT was resold for a whopping $6.6 million, he received 10% in royalties as well. Celebrities such as Snoop Dogg and Steve Aoki have been collecting royalties on their productions as well.

On the other hand, buyers can also benefit from NFT royalties. Because royalties are inherently attached to an artwork’s intellectual property rights, NFT projects that release IP rights to the buyers allow buyers to receive NFT royalties as well. For instance, holders of Yuga Labs’ BAYC, Cryptopunks, and Meebits have IP rights to their respective NFTs, and can choose to monetize their digital assets if they want to.

The Downsides

While most NFT marketplaces support royalty payments as a part of each transaction, it is very difficult to enforce them on a “P2P” level.

For example, if Bob agrees to buy an NFT from Alice without going through a marketplace, the original creator will not receive the royalties.

Besides that, some NFT marketplaces like Magic Eden, X2Y2 and Sudoswap are waiving royalty payments of certain NFT transactions that are performed on their platforms. These platforms announced that buyers can choose the amount of royalties they would like to pay, and that many other aggregators will soon adopt this pathway as well.

While this has sparked some debate in NFT Twitter, creators will remain at a disadvantage for now. As seen with Tyler Hobbs’ QQL generative NFTs, larger projects with their own ecosystem can protect their royalties by blocking these marketplaces. However, smaller creators still have to rely on major NFT marketplaces to list their artwork.

i think the creator royalty argument is actually a lot simpler than people make it out to be.

— beeple (@beeple) August 13, 2022

There is ZERO way to FORCE royalties technologically so creators will have to build a collector base that WANT to honor these royalties…. It’s really that simple. 🤷

Challenges Moving Forward

The competitive nature between NFT marketplaces may cause a race to the bottom with regards to NFT royalties. While buyers may choose such marketplaces due to the economical advantage, this comes at the expense of the creators. Ultimately, only time will tell if this can be a sustainable strategy for the industry.